To deeply understand the current CX, employee, and overall market research trends to identify which would be the most relevant topic to focus my project on, I printed out, read, and marked up each of the 2025 trend reports, walking away with a core insight that provided the backbone for the inspiration behind my parameter-informed simulation: synthetic data is here to stay.

Below, there is a section on each report with a few key findings and my commentary.

Core Prep: Understanding

Experience Management Trends

🌮 I'm serious - I actually deliver. 🌮

You can get tacos delivered to the Qualtrics Provo office.

On me. Freshly picked from Taco Bell.

But not just tacos. TACOS tacos.

The kind whose main ingredients are Transparency, being All-in,Customer-Obsession, being One-Team, and Scrappiness.

Hopefully you can tell I'm all in.

And I'll continue to deliver, day after day.

Just with less cheese and hot sauce, and more 11/10

effort across every project.

x

Process

Reading through each of these reports was fascinating, and it provided me with a much greater appreciation for the challenges that XM professionals are currently encountering in the face of this ongoing feedback recession.

Core insights that greatly impacted me were highlighted first by hand in the printed reports, which are scanned and uploaded beneath each trend's section.

I highlighted those same insights in their respective PDFs, and have uploaded screenshots to each section.

Text in italics is representative of my handwritten notes, with additional thoughts below them in normal, non-italicized text.

Market Research Trends

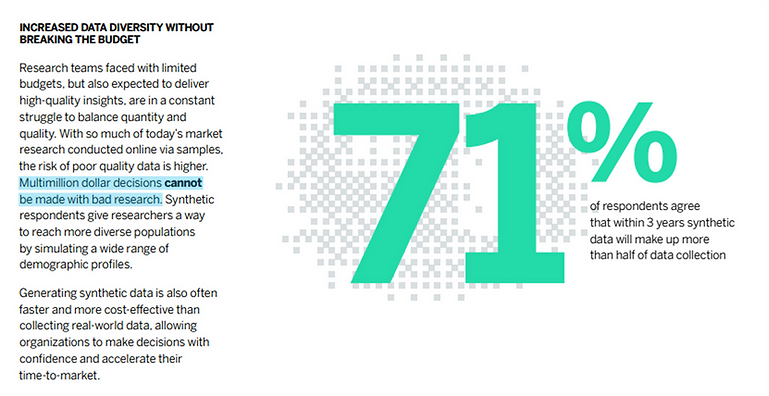

For me, this was the most fascinating report. From massive, continuous investments into synthetic research to the additional constraints added by increasing survey fatigue, it's quite apparent that research teams have both an incredible challenge and opportunity in the years to come.

.png)

Consequences of bad data

Which industries asking these multi-million-dollar questions are most at-risk if they get their research wrong?

How many of those are aware of Qualtrics and how many of those companies is Qualtrics aware of?

Millions of dollars are left on the table each year by not having properly designed surveys, improperly-sized population sample sizes, incorrect assumptions about key demographics, and more.

It would be really interesting to better understand the reasons why some companies engage in "bad research" and that also follow through on that research. Lack of investment/budget for dedicated partners like Qualtrics, top-down managerial decisions overriding core insights, poor survey design, etc.? Do they have their own internal metrics for what constitutes bad research, and what are they missing that's causing them to still underperform?

I think of the Ford Edsel, and how Ford conducted essentially zero test marketing with actual consumers, losing billions in today's money.

Obviously we don't know what we don't know - but do companies that engage in bad research also engage in other behaviors that are overlooked by them but more noticeable to Qualtrics?

AI x Researchers: decreased time to insights

The other 49% and 58%... why did *they* not experience improvements in time to insights or accuracy?

Is it competence, lack of good data sets, or what? Seems like TTI and accuracy would be natural byproducts if you have decent data and solid AI best-practice integration methodologies.

Always obsessed with the groups on the other side of any quoted statistics. "9/10 dentists recommend..." Ok, what about the 10th dentist?

The 49% that's not seeing improvements in time to insights - if they're using AI, are they just not prompting it correctly, or giving it enough context to produce actionable information?

Within the researchers surveyed, are there generational cohorts that are more or less likely to adopt AI/trust it and thus influence their time to insights? Are there internal development programs designed to get employees up to speed when it comes to AI adoption and best practices?

EMEA Region: high synthetic data usage

How well does the EMEA's position as one of the regions with the highest usage of synthetic respondents correlate with their current regulatory environment?

It's clear that their tenured professors have deeper connections with strategic decision makers, but my guess is that the quantity of those tenured professors combined with Europe's increasingly heightened focus on user privacy through GDPR regulation accentuates both the willingness to try "new types of research" (synthetic data useage) and the usage rate itself of that kind of data.

Especially over the last 5-10 years, the EU has expanded its efforts to combat what it perceives to be invasions of personal privacy by big tech, primarily by US firms.

While these efforts have seen their fair share of praise and critique, you can't help but assume that the current usage rates for this area, Europe particularly, go beyond just a static positive relationship of organizations relying on experienced researchers.

Although Europe hasn't experienced as intense economic growth as other areas, I'd assume their "willingness" to try new types of research isn't so much originating from a nice-to-have position as a need-to-have. Especially in a world dominated by a fallout of accurate tracking due to iOS 14 allowing consumers more privacy, it's no surprise that areas with regulatory environments like this contain organizations that see research teams' efforts - and the resources they use - as absolutely necessary for survival.

Initial report notes.

Please click to go full-screen.

Employee Experience Trends

From passive listening to adapting to new generations of employees as they begin their careers, there are challenges both old and new. Candidate and exit experiences remain more important now than ever, with significant opportunities to refine those experiences and boost retention.

Passive listening: perception vs adoption

I feel like the framing around passive listening is key for adoption. The current description "...which employees generate as part of their day-to-day activities without extra effort on their part" feels a lot more benign than maybe some of the sentiment around it that could have caused 41% to not feel comfortable with it. "Passive listening" is a phrase used internally here in this report, but I'm curious if there are alternative ways of branding it that make it sound less intrusive.

Again, always curious to hear about the % who responded that they weren't comfortable with it. Was it the framing, description of it, or what other factors are present that cause them to not be 100% on board?

Implementing passive listening isn't something you sign off on without some kind of consideration, so it also makes me curious that when programs like that do get green-lit, how do you consider the concerns of those who weren't comfortable with it post-roll-out?

As always, listening to your employees is crucial, and hearing their thoughts around important projects like these is paramount.

Gen Z retention efforts in

career dev programs

Wondering if some of the strategies discussed here work for a meaningful percentage of Gen Z simply because change in itself is novel. Assuming the outcome of the implementation of these suggested programs is non-negative, at what point can a strategy that focuses on providing novel learning environments at work that *aren't *necessarily hyper-tailored to a specific mobility program serve as a proxy for legitimate, specific career dev programs?

What does the minimum viable career dev or internal mobility program look like to increase retention among Gen Z?

This was really interesting advice to read - on one hand, it's assumed that companies that do implement specific programs like the ones mentioned above do have higher retention for younger cohorts.

On the other hand, there's a sort of survivorship bias here. Those most likely to report higher NPS scores for programs like that most likely also have the resources to 1) implement them and 2) devote extensive, continuous efforts over time to refine those programs to further increase retention.

So does this advice apply more specifically to companies that don't already have these? The answer is potentially yes, but it begs the question: if the resources aren't fully there to create what could be a high-retention program, what's the next best option for fully-fleshed career dev programs, and do those next-best options still serve as a meaningful substitute for retention?

Candidate and exit experiences

cannot be overlooked

This particular section, tailored toward Candidate and Exit experiences, provided some interesting ground to consider new perspectives. First and last impressions are obviously significant, but the phrasing around turning selected and non-selected candidates into brand ambassadors ties directly into one of Qualtrics' core tenets (outside TACOS, of course!): "turn brands into religions."

The previous page highlighted that "employees who are least likely to see a future with an organization are the ones who have just started."

The suggestions here offer a solution: an effective onboarding experience and 360 feedback are vital to understanding how they perceive their overall experience.

360 feedback is extremely important, but if a company's goal is to curate data beyond external requests for it, leaning heavily into the "brand to religion" aspect is going to be key, and ideally, an org doesn't learn what caused the exit in a post-mortem analysis or candidate exit interview..

Regardless of how an employee may have left, it's quite possible that the impressions garnered in more negative exit experiences by disgruntled employees can be tempered by regular check-ins during their time at a company.

Whatever the interval between those check-ins is, establishing the trust required to give honest feedback goes beyond asking for it: employees need to feel heard, and as good as external requests (employee feedback surveys etc.) can be, potentially asking them their preferred way of giving feedback might elicit more detailed and genuine responses, empowering them to meaningfully contribute and start demonstrating self-starting behavioral buy-in in a way that closely aligns with the "brands to religion" framing.

Initial report notes.

Please click to go full-screen.

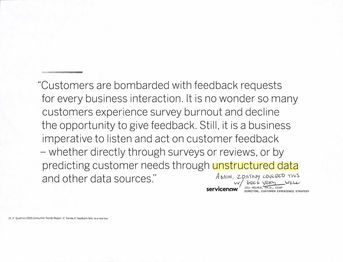

Consumer Trends

We're living in interesting times: the world is becoming increasingly connected, and AI proves to be helpful in allowing companies to better connect with their consumers, but a balance has to be struck between tech-oriented solutions and human-centered ones, recognizing the unique advantages of both.

AI: too much of a good thing (sometimes!)

Leonie hits the nail on the head here. We've all experienced companies with programs like these, primarily chatbots that aim to help but often leave you with more questions than answers.

Fairly prescient observation, too: Klarna is in the process of rolling back an extensive use of AI in customer service roles and is pivoting back to integrating real people into its workflows after their CEO admitted that "I just think it's so critical that you are clear to your customer that there will always be a human if you want." (Futurism)

Placing too much of an emphasis on the benefits of AI, like cost savings or other areas, rather than a genuinely excellent customer experience, will almost always lead to less than stellar outcomes.

I think Klarna will be a cornerstone case study (at least for a few more years!) of the dangers of trying to supplement - or almost entirely replace - the real with the artificial.

It does make you wonder what values guided the internal discussions that led to that AI focus in the first place. Beyond just the benefits of cost savings, what potential warning signs did they miss that led to these decisions?

Appreciating cultural differences

in AI personalization efforts

What do these insights tell us about the need to be aware of and prioritize cultural and language-specific messaging?

As a whole, romance-based languages tend to have a greater variability in emotional "amplitude," meaning those languages tend to express emotions more often and in more nuanced ways than others.

While all brands should strive to include as much empathy as is reasonable in their communications, messaging, and marketing, it stands to reason that being aware of who is buying your product is just as important as why they're buying it.

Understanding messaging that resonates on a sociocultural level and also on a product level is crucial. It's not enough to say that additional empathy resonates more with certain segments; it must be matched with messaging tailored to the way they perceive how the product solves their "job-to-be-done."

Initial report notes.

Please click to go full-screen.

Core Takeaway

Out of all the trends I had the opportunity to study here, it's clear that organizations with dedicated, cutting-edge research teams will outpace competitors who fail to quickly integrate synthetic data into their decision-making.

The combination of speed, cost-effectiveness, and increasing accuracy will only lengthen the gap between future-facing firms and their sluggish counterparts.

If there's one trend to construct a core project around, it's definitely the rise of synthetic data.

Further listening to podcasts from XM thought leaders centered on this topic only cemented this notion.

See notes and insights gained from podcasts featuring

Ali Henriques and Isabelle Zdatny.